Water technology company Aquafortus raises $17m in Series A1

Published on by Trudi Schifter, CEO and Founder AquaSPE in Business

Water technology company Aquafortus raises $17m in Series A1; purifies high-salinity brines, while extracting precious resources, affordably

AUCKLAND, New Zealand, Feb. 23, 2023 /PRNewswire/ -- Aquafortus, a water technology company that purifies high salinity brines and derives valuable metals and minerals from them in the process, today announced the closing of a $17 million oversubscribed Series A1 financing led by DCVC and Novo Holdings, and joined by Universal Materials Incubator, Intrepid Financial Partners, Envisioning Partners, Burnt Island Ventures, K1W1 and NZGCP.

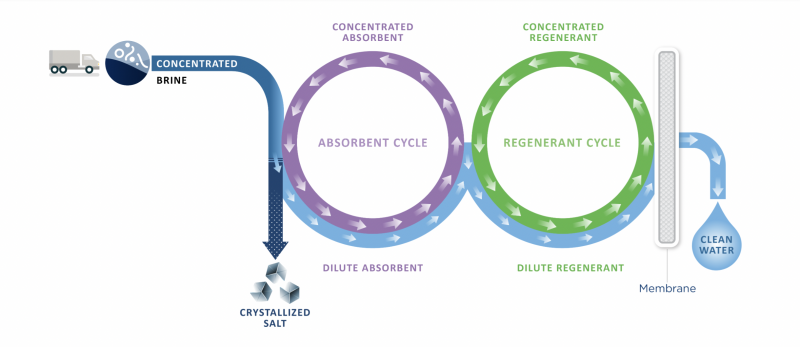

Until now, brine desalination has been prohibitively expensive: thermal-based evaporation, the most common technology today, is highly energy-intensive. Aquafortus uses a non-thermal, zero-liquid-discharge recovery and crystallization approach that uses 90% less energy, costs 60% less, and turns 98% of high salinity brine into fresh water, while extracting lithium, copper, magnesium salts, and other metals and minerals.

"The world must shift toward greater reuse of existing natural resources," said DCVC Partner Jason Pontin. "The imperative is most pressing with water: every continent experienced drought last year, and many of the Earth's largest aquifers have tipped toward depletion. DCVC enthusiastically backs Aquafortus because it is the first company to meet the dire environmental need to desalinate the toughest brines effectively and affordably."

Aquafortus targets industries that produce significant volumes of hypersaline water: mining, oil and gas production, chemical manufacturing, and power generation. The Series A1 financing will allow the construction and deployment of a relocatable demonstration unit and commercial pilot across major US Oil and Gas basins and operators, as well as investment in core R&D.

The world generates a significant volume of industrial wastewater (380 billion m3/year). About 25% of this is hypersaline wastewater—or three times the volume of Lake Mead at its peak.

"We are committed to producing fresh water and precious metals and minerals from brines that are notoriously hard to treat," said Daryl Briggs, CEO, Aquafortus. "We designed our technology to be both highly effective and much less demanding of energy than anything on the market: this combination can significantly improve water availability and critical mineral abundance in many regions across the world."

Aquafortus offers value not just in what its technology delivers, but also in what it prevents. Today, heavy brines are usually disposed of as waste. When they are released into the ocean, they can interfere with the coastal ecology, and their injection into the earth is recognized as a key factor in seismic activity. Brines produced from mining operations are especially expensive to treat, but also contain massive amounts of metals and minerals that can be recovered, not wasted.

Stephen Van Helden, Principal, Novo Holdings Equity, a wholly-owned subsidiary of Novo Holdings, said: "The investment in Aquafortus and its innovative technology is in perfect alignment with our purpose at Novo Holdings, which is to improve people's health and the sustainability of society and the planet and to generate attractive long-term returns on the assets of the Novo Nordisk Foundation. Aquafortus is reducing water insecurity while improving the environment. I am very excited about our future collaboration and our shared ambition to contribute to a more sustainable planet."

"Aquafortus provides a revolutionary solution for a critical problem facing many industries, particularly energy," said Skip McGee, co-founder and CEO of Intrepid Financial Partners, the leading energy merchant bank. "When we speak to energy executives across the U.S., managing produced water is a top priority. Existing solutions such as saltwater disposal wells and traditional recycling technologies will not be able to meet the challenge. New solutions are essential, and Aquafortus's cost-effective and energy efficient technology for treating water with zero liquid discharge and monetizable mineral extraction is potentially game-changing for the energy industry."

About Aquafortus

Aquafortus is a New Zealand headquartered technology company that develops and commercialises novel and proprietary minimal energy resource recovery technologies for high total dissolved solids (TDS) waste and process streams. The team at Aquafortus are high-calibre, global experts working to bring the most advanced zero liquid discharge resource recovery technologies to the world.

About DCVC

DCVC, the leading Deep Tech venture firm, backs entrepreneurs solving trillion-dollar problems to multiply the benefits of capitalism for everyone, while reducing its costs. For over twenty years, DCVC and its principals have backed brilliant entrepreneurs. By applying Deep Tech, from the earliest stage and beyond, we pragmatically and cost-effectively tackle previously unsolvable problems in nearly every industry, especially those that haven't seen material technological progress in decades. Together, we have created tens of billions of dollars of value, while also making the world a markedly better place.

Visit us at dcvc.com or follow us on Twitter @DCVC.

About Novo Holdings

Novo Holdings is a holding and investment company that is responsible for managing the assets of the Novo Nordisk Foundation, one of the world's largest enterprise foundations. The purpose of Novo Holdings is to improve people's health and the sustainability of society and the planet by generating attractive long-term returns on the assets of the Novo Nordisk Foundation.

Wholly owned by the Novo Nordisk Foundation, Novo Holdings is the controlling shareholder of Novo Nordisk and Novozymes (the Novo Group companies) and manages an investment portfolio, with a long-term return perspective. Novo Holdings invests in life science companies of all stages of development and also manages a broad portfolio of equities, bonds, real estate and infrastructure assets as well as private equity investments. As of year-end 2021, Novo Holdings had total assets of USD 106 billion.

Further information: www.novoholdings.dk.

Taxonomy

- Nutrients Recovery

- Desalination

- Brine Discharge Modeling & Analysis

- Sustainable Desalination

- Groundwater Salinisation