Investing in Desalination Companies

Published on by Water Network Research, Official research team of The Water Network in Business

As it turns out, there are quite a few investors out there who are interested in desalination investing.

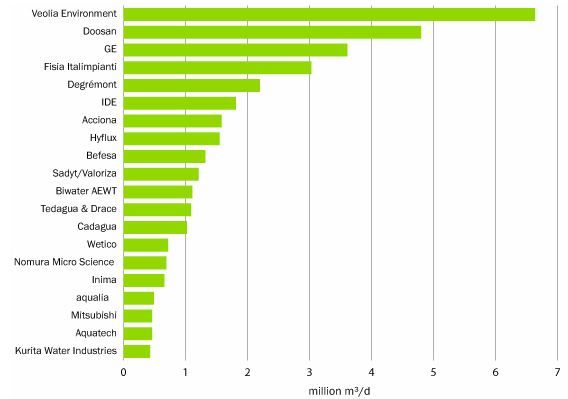

Unfortunately, there aren’t really any U.S. traded pure-play desalination stocks for retail investors to invest in. We highlighted the 20 biggest desalination companies before and not one of these companies was a publicly traded U.S. company. The list can be seen below:

Many of these companies are private, and of the companies that are publicly traded in other countries, the majority have water-related revenues at less than 50%. There is one single company traded in Singapore that is worth a look but the rest just don’t have the exposure to desalination we are looking for.

The State of the “Desalination Industry”

The thing about desalination is that it’s not a new technology. There are many countries today that have no other alternatives to obtain water except to ship it in by boat or extract it from the sea.

The thing about desalination is that it’s not a new technology. There are many countries today that have no other alternatives to obtain water except to ship it in by boat or extract it from the sea.

In these sorts of places, the plants may be quite costly to run but they have no viable alternatives since shipping in water would be far too costly.

Desalination plants are used in many areas of the world besides island countries with Saudi Arabia actually being the biggest consumer of desalination plants globally as seen below:

The world’s largest and most advanced desalination plant was recently completed in Israel and now comprises 20% of the country’s municipal water demand. The most attractive characteristic of the “water desalination industry” (if you want to call it that), is that it is highly fragmented and a great deal of the older plants use inefficient legacy technologies like thermal desalination.

![]()

The Value Proposition of Aquaventure Holdings LLC (NYSE:WAAS)

The business model of Aquaventure Holdings LLC (NYSE:WAAS) is to seek out desalination plants with legacy technologies, acquire them, and then convert them to long-term “water-as-a-service” (WAAS) contracts. The technology is then upgraded, for example from thermal desalination to reverse osmosis desalination, which then makes the plants much cheaper to operate. The commercial consumer or government then pays a fixed amount per gallon of water over a typical period of 10 to 20 years. WAAS is now a leading provider of water to the Caribbean market.

As time goes on, companies will continue to develop better desalination technology like the forward osmosis technology that Oasys is developing as an example or the nanomembranes that NanoH2O was developing before they were acquired by LG Chem in 2014. This means that the cost to operate these plants will decrease even more.

The pace of technology might stay on track such that Aqua can keep the cost of their WAAS fixed and improve their margins over time to increase profits without charging more for their water.

AquaVenture Business Lines: Water-As-A-Service

AquaVenture Holdings focuses on providing “Water-as-a-Service,” which generates recurring fixed revenue streams following the deployment of advanced water purification and desalination technologies.

The Company has two high-growth subsidiaries. The first is Quench which provides filtered drinking water to 50,000 companies across the United States. The second is Seven Seas Water which operates large seawater desalination and wastewater treatment plants internationally.

Across both of these subsidiaries, WASS delivers about 20 million gallons of clean water every day. The percentage of revenues attributed to the Seven Seas Water subsidiary was 47% of 2015 revenues so nearly half of their revenues can be attributed to desalination. Including both organic and inorganic growth, AquaVenture’s compounded annual growth rate, or CAGR, for revenue, was 40.5% from 2010 to 2015.

Read full article at: Nanalyze

Media

Taxonomy

- Technology

- Desalination

- Water Management

- Desalination Plant

- Business Analysis

- Markets

- Desalination