Financing universal access: the role of Water Financing Facilities

Published on by Catarina Fonseca, IRC - Head Innovation and International Programme

Financing universal access: the role of Water Financing Facilities

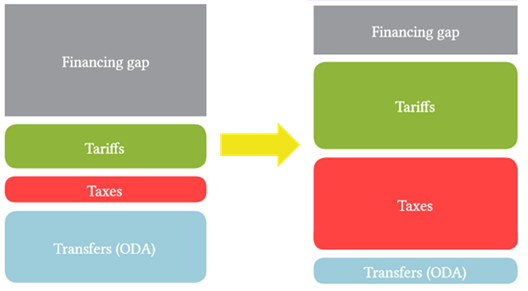

Traditionally we've looked to the three Ts to finance water, sanitation and hygiene (WASH) services, with the focus on transfers and tariffs. But this leaves a large financing gap. One which, if we don't solve, will make us miss the Sustainable Development Goal (SDG) of universal access.

One way to tackle this is to grow the share that comes from taxes - that's how we do it in the developed world. But even this is unlikely to give us the surge in investment needed to meet the SDGs. So we need something else. One bright idea - that has worked in many northern countries - is a sector financing facility. This will only work in certain circumstances - but when these are met, the model has real potential.

It's all about risk

Many utilities in low and middle income countries have difficulty to access loans to make long term investments. Not because the money is not available in the financial markets but because banks and other debt providers consider the financing too risky, resulting in either no lending or in high interest rates (often more than 14%) and short tenures (about 3-7 years to pay back the loan while 15-30 years loans are preferred). It's risky because the utilities often do not have an appropriate credit rating, do not have a track record in borrowing, and can often only provide limited guarantees to ensure that the debt service (the interest and pay back of the loans) can be paid back over a long period of time.

50 years ago the Dutch Water sector was facing the same problem. The Nederlandse Waterschapsbank (NWB Bank) (Dutch Water Bank) was established in 1954 to address this problem. Its mission was to finance the Dutch Water Boards as cheaply as possible and not aim at profit maximisation. The fact that the NWB was backed by a guarantee from the Dutch national government made it possible to attract money at low interest rates and long tenures. Today the NWB has a balance sheet of 88 billion Euros and there has never been a default on a loan. There are similar public sector banks in Europe such as KfW in Germany, Kommuninvest in Sweden and Agence France Locale in France.

Too little and too slow

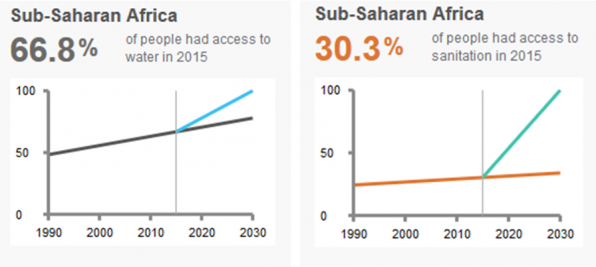

The World Bank estimates that we will need investments of US$45 billion per year to achieve universal coverage in the water and sanitation sector by 2030. The problem is not limited to the amount of funds available. The latest data fromWASHwatch.orgshows that in Sub-Saharan Africa the speed of investments is too slow. We are not on track. At the present investments and growth rate we will not reach universal coverage for water (Figure 1) or sanitation (Figure 2). The light blue lines shows the increase in rate required to achieve the targets.

Figure 1 & 2: Investments required to achieve 2030 targets for water and sanitation. Source: WASHwatch.org

Figure 1 & 2: Investments required to achieve 2030 targets for water and sanitation. Source: WASHwatch.org

The big questions

- How are we going to fund universal access?

- How are we going to speed the trend of investments leading to higher coverage rates, faster?

- What can the role be of Financing Facilities in all this?

The 3 Ts provide the framework in which we can find an answer (Figure 3). The challenge being to grow all sources of financing to reduce the gap and in different proportions. Traditionally the WASH sector has focused on aid - the T of transfers. We have been lobbying for countries to commit to 0.7% of GDP to aid. But even if this is achieved, it will only ever provide a small percentage of the overall financial needs of the sector. Secondly we have focused on the second T, on tariffs: ensuring that utilities and water companies set tariffs that cover at least operation and maintenance costs. Under this heading we also need to take account of households own contributions to construction of their own infrastructure (including payments required for loans).

What we have seen over the years, however, is that together these two Ts are simply not enough. We need the levies and / or taxes that can be raised to deliver the services to the public! This is the single largest source of funds for public goods and infrastructure dependent sectors like ours. We need the money that has allowed us in Europe, in the US, to get access to universal access to services.

Figure 3. Source: Norman, G., Fonseca, C. and Tremolet, S. 2015. www.publicfinanceforwash.com

Figure 3. Source: Norman, G., Fonseca, C. and Tremolet, S. 2015. www.publicfinanceforwash.com

The role of Water Financing Facilities

On their own, however, and even with growth in revenue from taxes, the 3 Ts will not provide finance fast enough with volume high enough to cover the financing gap: particularly where this relates to new infrastructure for first time access. We also need mechanisms that allow us to use some of the existing Ts (taxes, tariffs and transfers) to attract additional (largely) private finance. And this is where Water Financing Facilities come in.

Water Financing Facilities are a potential mechanism to mobilise additional finance for the sector. They pull utilities and their projects together reducing risk and therefore creating the possibility for longer term loans at considerably lower interest rates. These types of facilities are at the moment being implemented in Colombia and India to address the problems mentioned above. See this animation that explains the concept. Here

Conditions for success of Water Financing Facilities

The most important conditions that need to be fulfilled for successful Water Financing Facilities can be grouped as follows:

| Financial sector |

|

| WASH sector |

|

Not all countries fulfill all these conditions. In fact, our first analyses show that in some of the poorest countries the financial sector is simply too underdeveloped, some countries just having issued their first sovereign bonds, or having very limited pension funds.

What is more, money alone typically does not resolve the challenges of underperforming utilities. Preliminary scoping missions to some countries and reports from other International Financial Institutions indicate that it is very important to strengthen the performance of utilities to become viable companies through for instance initial investments to reduce non-revenue water, ensuring overall better services to their customers and supporting them to have sound investment plans that can be submitted to Financing Facilities. This often requires initial investments from taxes or transfers for utility reform processes.

In conclusion

Existing financing methods in the sector are not enough in terms of volume and in terms of their capacity to speed up coverage, leaving ample space for financing innovation in this sector.

Water Financing Facilities have real potential to be part of the solution for decreasing the financing gap in the water and sanitation sector in countries: leveraging tariffs, taxes and transfers (development aid) and releasing finance to the sector. For some countries where the necessary conditions are met this is a real and high potential solution now, while for other countries it's too early since they still need to work on their credit worthiness or benchmarks in the sector.

IRC is supporting the Dutch Ministry of Foreign Affairs towards the Financing for Development Conference in Addis where some of these financing mechanisms will be further explored. I wish to thank the following people for their inputs: Frenk van der Vliet Director at the Nederlandse Waterschapsbank N.V. and the team of experts working on this concept with the Dutch Ministry of Foreign Affairs: Dick van Ginhoven, Jean Pierre Sweerts, Maarten Blokland and Joris van Oppenraaij.

------------------

Author: Catarina has eighteen years of experience in development cooperation and fifteen in the water supply and sanitation sector. She has pioneered sector development on the understanding of life-cycle costs and financing. She is the Chair of the IRC Leadership team and is Head of the International and Innovation Programme of IRC. Catarina has a passion for evidence and data in support of good governance. Read her original blogs here

Author: Catarina has eighteen years of experience in development cooperation and fifteen in the water supply and sanitation sector. She has pioneered sector development on the understanding of life-cycle costs and financing. She is the Chair of the IRC Leadership team and is Head of the International and Innovation Programme of IRC. Catarina has a passion for evidence and data in support of good governance. Read her original blogs here