Consolidated Water Stock Pick of the Week

Published on by Water Network Research, Official research team of The Water Network in Business

The water stock Consolidated Water Co. Ltd. (Nasdaq: CWCO) is the Money Morning Pick of the Week

As a micro cap with a valuation of just $166 million, CWCO stock is a more speculative play than our usual Pick of the Week.

But Consolidated Water stock also taps into one of what Money Morning Chief Investment Strategist Keith Fitz-Gerald likes to call "unstoppable trends." In this case, the trend is scarcity and allocation.

Let's take a closer look at this unusual water stock…

Consolidate Water Co.: About the Company

Consolidated Water was founded in 1973 as a private water utility called "Cayman Water Company" in Grand Cayman, the largest of the Cayman Islands. In 1975, it installed its first desalination unit in Grand Cayman, and secured a 20-year water production and distribution license for the island in 1979. In 1989, Consolidated Water opened its first reverse osmosis desalination plant, a technology the company has continued to develop and still uses today.

Consolidated Water was founded in 1973 as a private water utility called "Cayman Water Company" in Grand Cayman, the largest of the Cayman Islands. In 1975, it installed its first desalination unit in Grand Cayman, and secured a 20-year water production and distribution license for the island in 1979. In 1989, Consolidated Water opened its first reverse osmosis desalination plant, a technology the company has continued to develop and still uses today.

This water stock went public on the Nasdaq exchange in the United States in 1996 (the Cayman Islands are a British overseas territory). Two years later it changed its name to Consolidated Water Co. Ltd.

After the turn of the century, Consolidated Water expanded rapidly, buying seven companies over 10 years. By 2014, the company had expanded its total water production capacity to 26 million gallons per day. As of last year, Consolidated Water had 14 desalination plants operating in six countries.

Consolidated Water employs about 120 workers. Revenue for 2015 was about $59 million.

A Consolidated Water Stock Overview

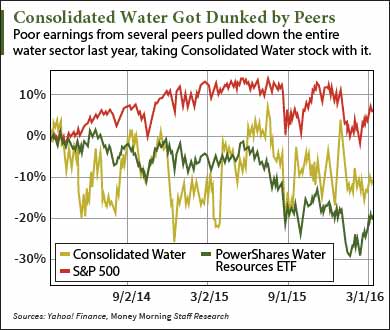

Over the past two years, this water stock has been range-bound, mostly trading between $10 and $13. CWCO stock also has underperformed the market, losing 11.80% in that time versus a 5.90% gain for the Standard & Poor's 500 Index.

On the other hand, the overall water industry, as represented by the PowerShares Water Resources ETF (NYSE Arca: PHO), is down 20.20% over the past two years. As a small and relatively obscure player, CWCO stock appears to have gotten swept up in the earnings hiccups several bigger water stocks experienced last year that pulled the entire sector down.

But the long-term prospects for water stocks have never been better. And the investment case for CWCO stock is particularly strong…

Source: Money Morning

Read More Related Content On This Topic - Click Here

Media

Taxonomy

- Finance and Markets

- Stock Exchange

- Finance